TIMELINE:

August 2016 to September 2017

TOOLS USED:

Sketch, InVision, Principle, Illustrator, Photoshop

ROLE:

UI/Visual designer, UX designer

KEY ACTIVITIES:

Ideation, user research, interface design, prototyping, interaction design, usability testing

Can You Imagine...

Today, mortgage services, acquisition, asset management and securitization businesses still remain mostly manual processes. Auditors, underwriters, QC and loan officers continue to manually input, extract, overwrite and deliver data using LOS and Excel. Utilizing multiple applications for each of activities/tasks is complex and limits visibility to connected stages.

We see an opportunity to make a difference and offer a more manageable, efficient and transparent product experience to solve financial challenges.

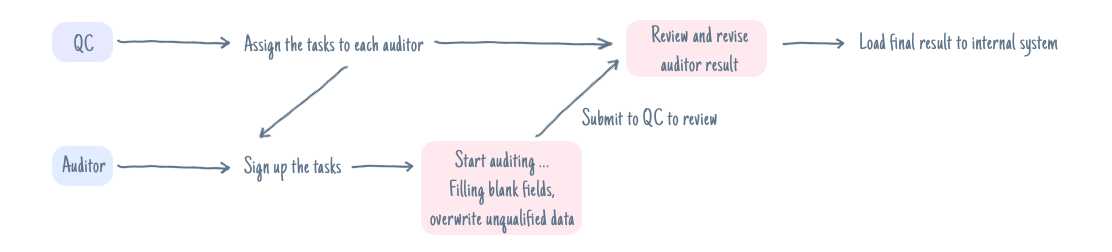

Today's Auditing Process:

Problem Space

In order to fix traditional mortgage servicing, we found 4 problems base on the current auditing process and the current design:

The old auditing process to fill blank fields, find unqualified data and overwrite data manually is inefficient and time consuming.

The output from auditor isn't accurate so QC needs put more time and effort for review and revise it.

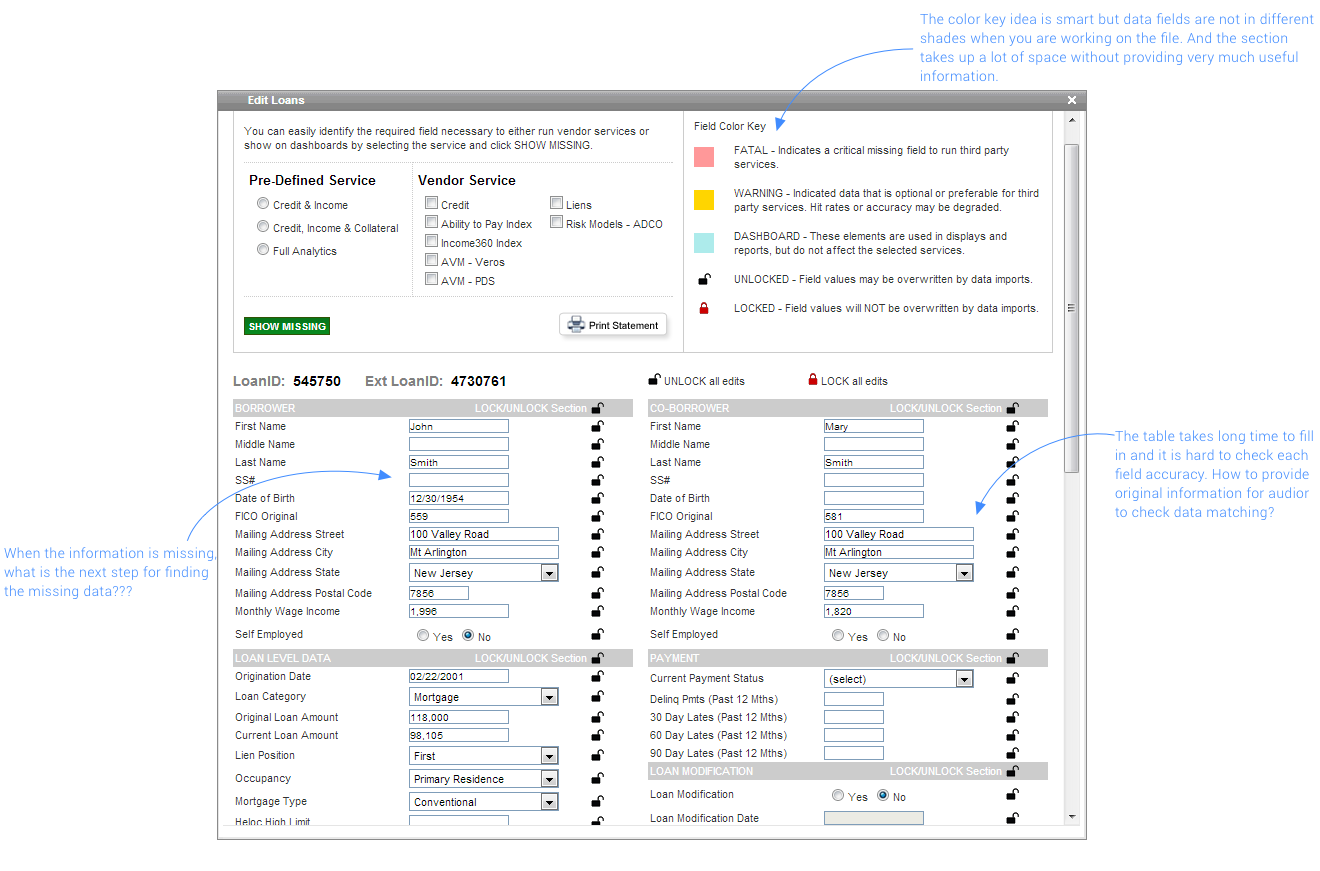

The standing audit interfaces are hard to use and lagging.

Multiple applications for each stages are complex and inefficient.

In Solving the Problem

We have 2 ways to improve the efficiency and accuracy:

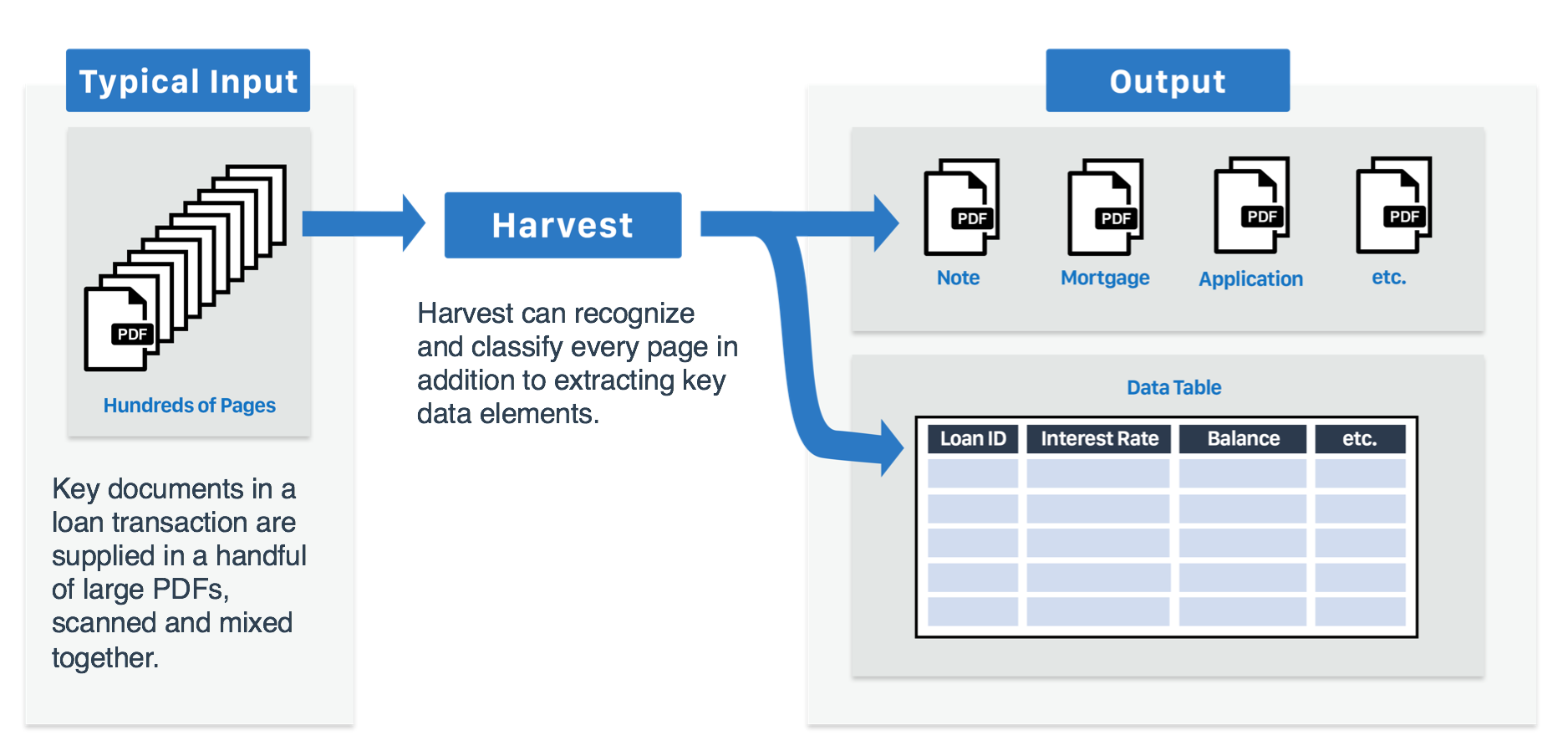

OCR Technology Support

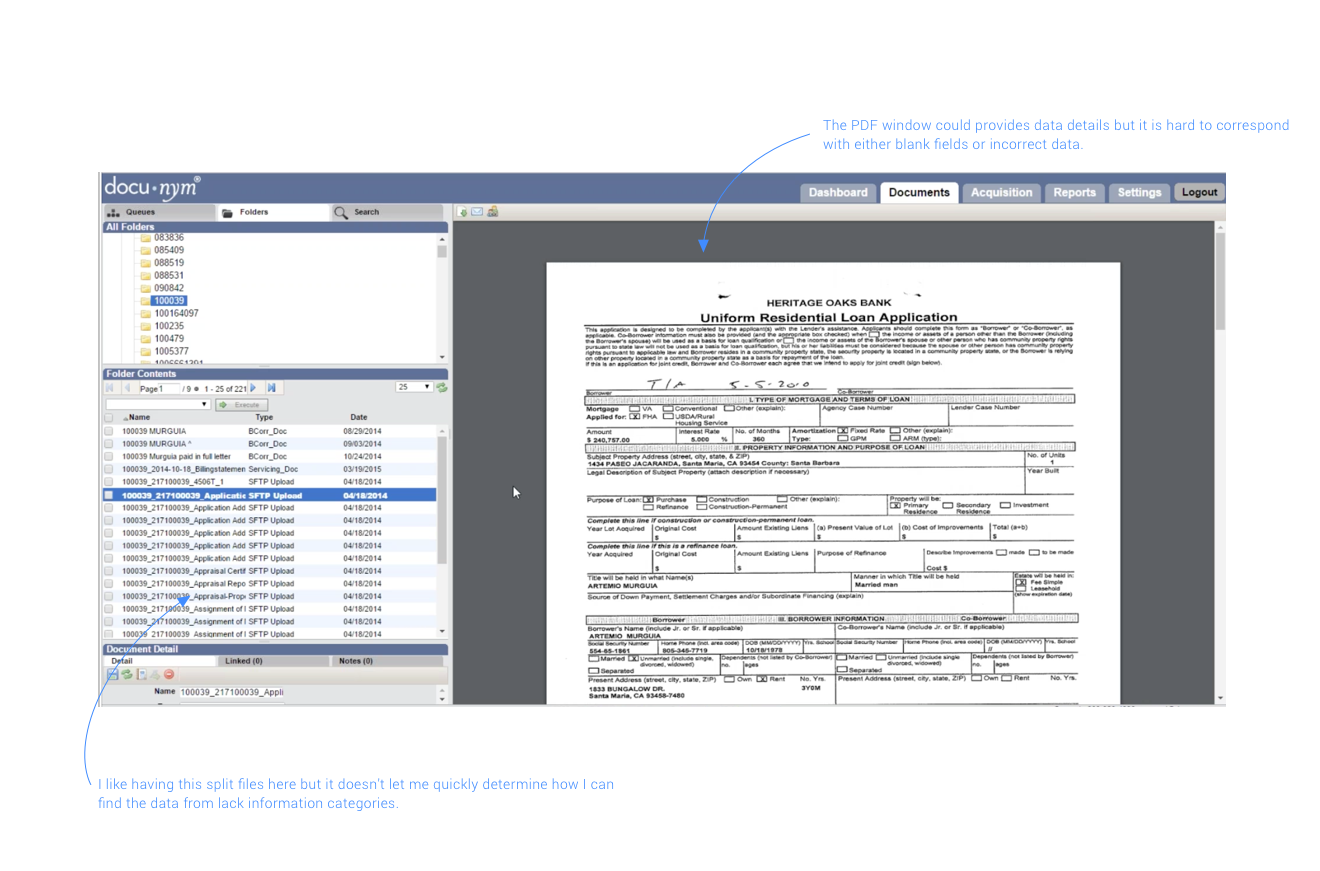

Once a mortgage is originated, sellers submit the “loan package” to buyers consisting of hundreds of pages of imaged documents (generally PDFs)

Harvest has database of 730 recognized document templates and over 250 distinct document types

Proprietary technology converts files into PDF format and utilizes OCR software to identify scanned/electronic files

Our product is a cloud based software that recognizes and indexes various loan documents. In addition, document imaging, indexing, and data extraction helps simplify the process to ensure timely follow-ups. Harvest ensures consistency and transparency while providing accurate reporting throughout the process.

Redesign Product Experience

Research

Some insights from user study:

I created a user persona to epitomize Harvest’s target user and visualize various aspects of their behaviors and frustrations. This persona was roughly based on the users interview. We focus on the below:

• Flexible/customizable interface

• Increase productivity and accuracy

• Simplify the process for data input, over writing and delivery of the final file

• No training requirements for new technology

Competitive Analysis:

Research conducted from other loan products to gather the hint from their work flow and analyze pros and cons for the product features.

Some assumptions:

What if the user could find data and information more quickly and easily (instead of having to read through the PDF)?

What if the software helps user indicate the unqualified data?

What if the software provides useful tools for managing the progress and timeline enabling a better teamwork?

Early Stage Concepts

After gleaning relevant insights from both user interviews and research, we distilled the following 4 design implications. These design implications helped guide subsequent ideation and prototyping:

Redesign User Flow

Old software user flow:

New solution for streamlining the audit process:

User flow between QC and auditor:

The user flow demonstrates when the auditor and the QC works on a same loan file. It shows the first task submitted by the auditor, if it was approved or rejected by the QC, and finally the feedback from the QC to original auditor.

In order to aggregate all the different stages and sources into a single application, our product should include the functions: fill and over write the data fields, check and view original files, upload files to system, obtain results, update status, etc.

Information Architecture

Low-Fidelity Sketches

Into the Details

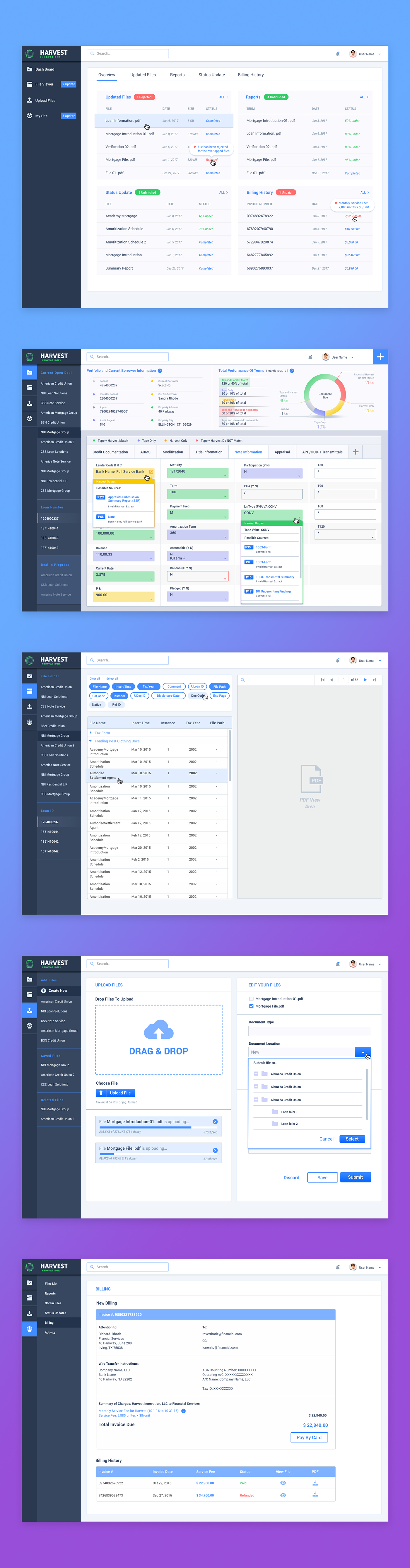

The ultimate goal is to design the most efficient way to find data from large PDFs. Harvest technology helps classify each page to extract key elements. Color code helps classify data after extraction so the auditor could focus on the DO NOT MATCH data. The page # button takes you to that specific PDF page to show the related information.

Function Analysis

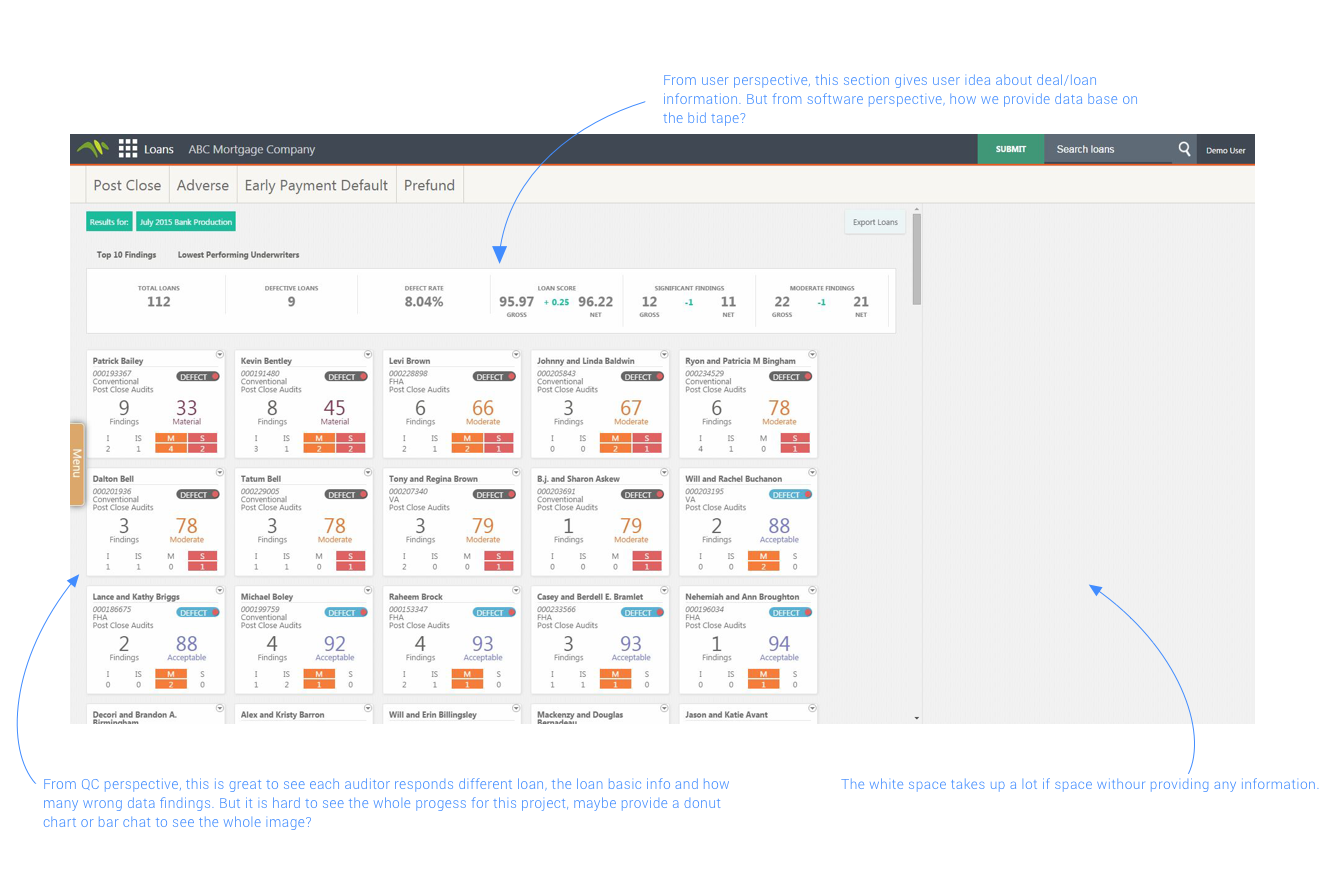

A good dashboard gives the user a snapshot of the most relevant information he/she needs to know, without making he/she navigate to another screen. I analyzed the audit task page and created specs that helped create the prototype.

The new design allows QC to check the work progress, how many auditors are working on the deal, and how much work has been completed or pending. Easy to check the loan status from each auditor's job.

UI Components

Evaluate The Solution

How did we test it?

User testings was conducted and the result came out successful: most of the loans had a 100% accuracy rate during the test and the % of loans competed under 60 mins was 57%. The following is a table demonstrating 6 transactions and 6 auditors active between July 23, 2017 and August 10, 2017.

5 out of 6 auditors are completing a minimum of 50% of their loan audits under 60 mins.